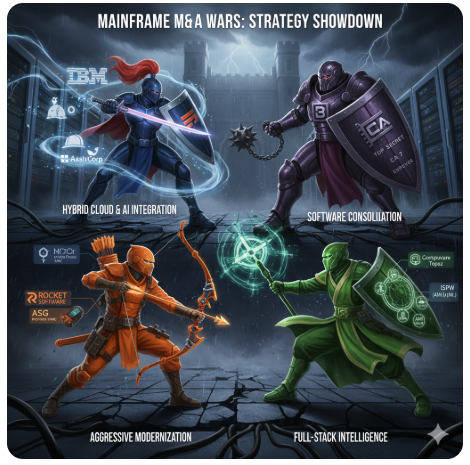

TL;DR: While Broadcom and Rocket are buying up legacy mainframe tools like they’re collecting Pokémon cards, IBM dropped $40+ billion on Red Hat and HashiCorp to turn the mainframe into a hybrid cloud beast. BMC went full DevOps with the Compuware acquisition. The mainframe modernization wars are heating up, and each player has a radically different strategy.

The Setup: Four Players, Four Wildly Different Strategies

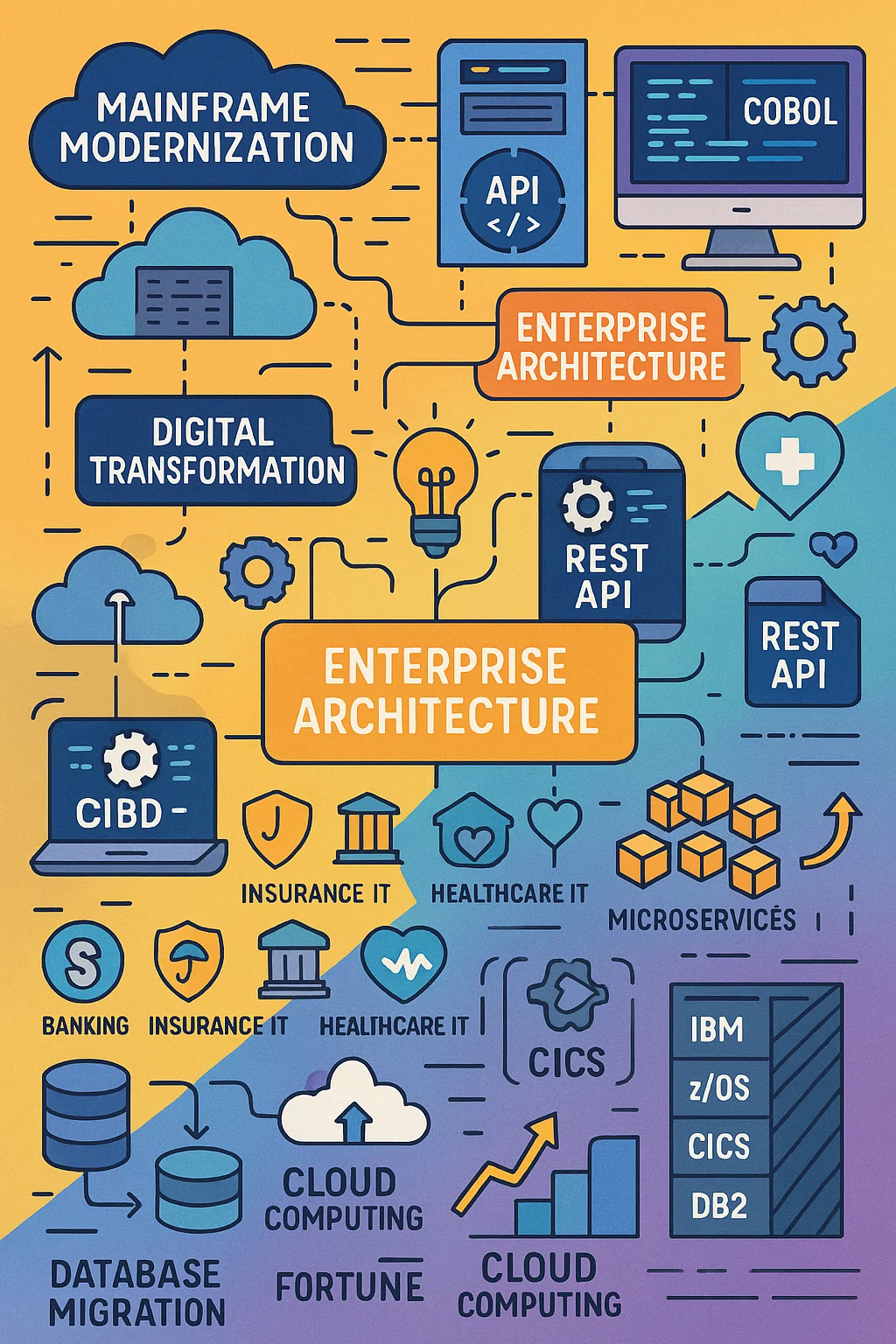

So here’s the thing about mainframes in 2025—they’re not going anywhere. Like, at all. Every time someone writes a “mainframes are dead” article, a COBOL programmer somewhere is laughing all the way to the bank. These machines handle more than 30 billion transactions daily. The global mainframe market is projected to grow from approximately $3.45 billion in 2025 to around $6.89 billion by 2035, with digital transformation and hybrid cloud integration driving growth.

You don’t just “migrate away” from that kind of infrastructure.

But the market is being carved up by four completely different philosophies around mainframe modernization, application development, and enterprise software strategy:

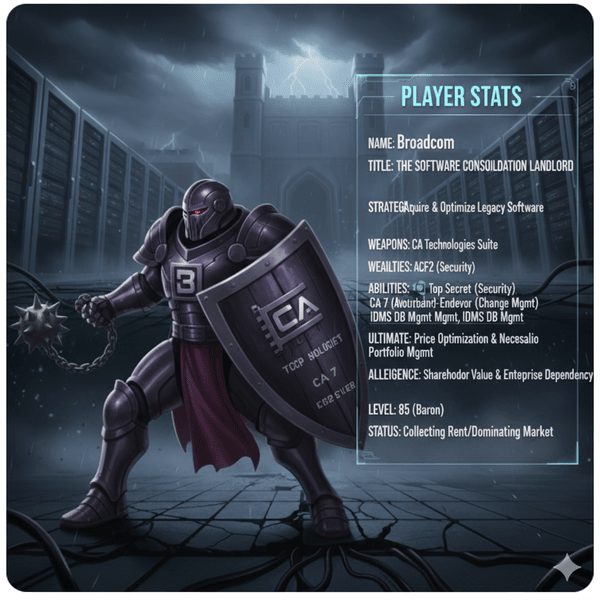

Broadcom: The Landlord Strategy (Pure Software Consolidation)

In 2018, Broadcom straight-up bought CA Technologies for $18.9 billion and basically became the landlord of legacy mainframe software. They got the crown jewels of mainframe operations:

- Security tools (ACF2, Top Secret – if you know, you know)

- Workload automation (CA 7, ESP – the stuff that runs your batch jobs at 3 AM)

- DevOps tools (Endevor, the change management system everyone loves to hate)

- Database management for IDMS and DB2 administration

Their play? Classic software consolidation. Raise prices, optimize the portfolio, and collect rent from enterprises who have zero choice but to pay for mission-critical tools. It’s not sexy, but it prints money in the mainframe software market.

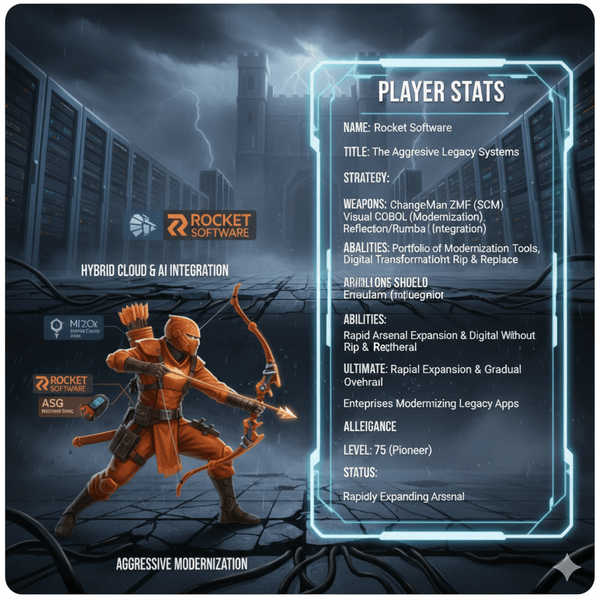

Rocket Software: The Scavenger Strategy (Aggressive Modernization Portfolio Building)

Rocket saw Broadcom’s playbook and said “hold my beer.” They’ve been on an acquisition spree focused on mainframe application modernization:

- 2021: Grabbed ASG Technologies (TMON performance tools, REXX scripting)

- 2024: Dropped $2.28 billion on Micro Focus’s Application Modernization & Connectivity (AMC) portfolio from OpenText

That second one is massive for the mainframe DevOps space. They got:

- ChangeMan ZMF (the other major change management system)

- Visual COBOL (for COBOL modernization efforts)

- Reflection/Rumba (terminal emulators that everyone still uses)

- Verastream (host integration and legacy API development)

Rocket’s basically consolidating the “keeping old stuff running while slowly modernizing it” market. Their strategy centers on application lifecycle management and digital transformation without ripping out the core platform.

BMC: The DevOps Evangelist Strategy (Full-Stack Mainframe Intelligence)

BMC took a different angle entirely. In 2020, they acquired Compuware in what was one of their largest strategic acquisitions. This wasn’t about operations management—it was about bringing modern DevOps practices and agile development to the mainframe development side.

What they got in the Compuware acquisition:

- Topaz suite (modern IDE for mainframe development with Eclipse-based tooling)

- ISPW (source code management and release automation for z/OS)

- Compuware’s classic product portfolio (debugging, testing, performance tools)

The play here is fascinating: BMC already owned the operations side with their AMI (Automated Mainframe Intelligence) suite, which uses AI and machine learning for predictive analytics and automated operations. Adding Compuware gave them the full DevOps pipeline—from code commit to production deployment on mainframe systems.

The BMC Vision: They’re betting that if you give developers modern tools that look like IntelliJ or VS Code but work with COBOL/PL/I, you solve the talent problem. They’re not trying to make the mainframe cloud-native—they’re making mainframe development feel like any other platform, addressing the skills gap head-on.

Their Control-M workload automation (which also runs on distributed systems) ties it all together. One workflow orchestration tool across your entire hybrid cloud environment and on-premises infrastructure.

The recent twist: In October 2024, BMC announced they’re splitting into two independent companies—one for mainframe (with the Compuware tech and AMI), one for their Helix ITSM business. The mainframe business is apparently so strong they’re spinning it off as a standalone entity. That’s… not what you do with a dying platform. This signals massive confidence in the mainframe market growth potential.

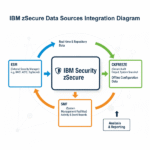

IBM: The “Actually, This Is a Cloud Computer” Strategy (Hybrid Cloud Integration)

And then there’s IBM. They spent $40.4 billion on two acquisitions that made everyone go “wait, what?”

Red Hat ($34B, 2019): Not a mainframe company. It’s a Linux/open-source company focused on cloud infrastructure. But here’s the play—they brought:

- OpenShift (Kubernetes for containers and cloud-native development)

- Ansible (infrastructure as code automation across hybrid environments)

- RHEL on Z (Red Hat Enterprise Linux running on mainframe hardware)

HashiCorp ($6.4B, 2024): Also not a mainframe company. They make multi-cloud infrastructure automation tools:

- Terraform (infrastructure as code—and yes, there’s a z/OS provider for mainframe provisioning)

- Vault (secrets management and security automation that actually works)

Why IBM’s Strategy Is Low-Key Brilliant (The Hybrid Cloud Play)

Here’s what IBM figured out: Nobody wakes up excited to learn COBOL. The mainframe’s biggest problem isn’t technology—it’s the generational cliff. Every year, more mainframe experts retire, and exactly zero CS grads are learning JCL for application development.

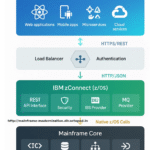

So instead of doubling down on proprietary mainframe tooling, IBM said: “What if we make the mainframe just another node in your Kubernetes cluster?”

This is the hybrid cloud integration strategy in action.

The Technical Reality of Mainframe Modernization

With OpenShift on z/OS, you can now:

- Deploy containerized apps on the mainframe using the same YAML files you use in AWS or Azure

- Manage it with the same kubectl commands your DevOps team already knows

- Monitor it with the same Prometheus/Grafana stack you use everywhere else

With Terraform, you can provision mainframe resources in the same infrastructure as code script that spins up your Azure VMs or AWS instances. One codebase. One workflow. True hybrid cloud orchestration.

This is insane. They’re making a 1960s architecture speak 2020s cloud-native language. This is digital transformation at the platform level.

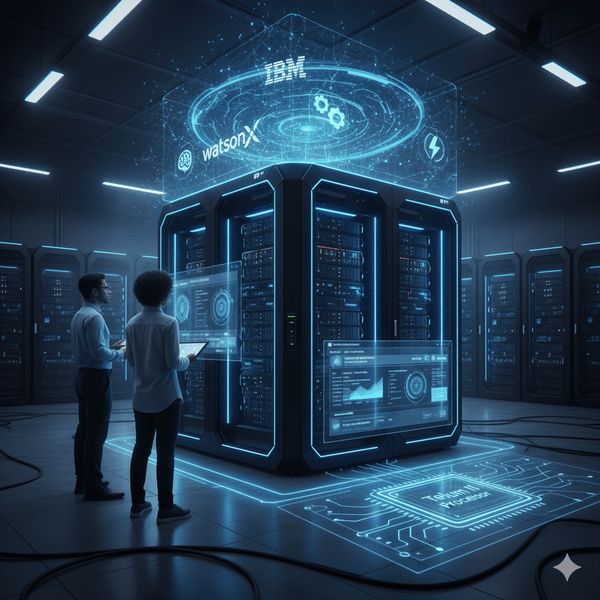

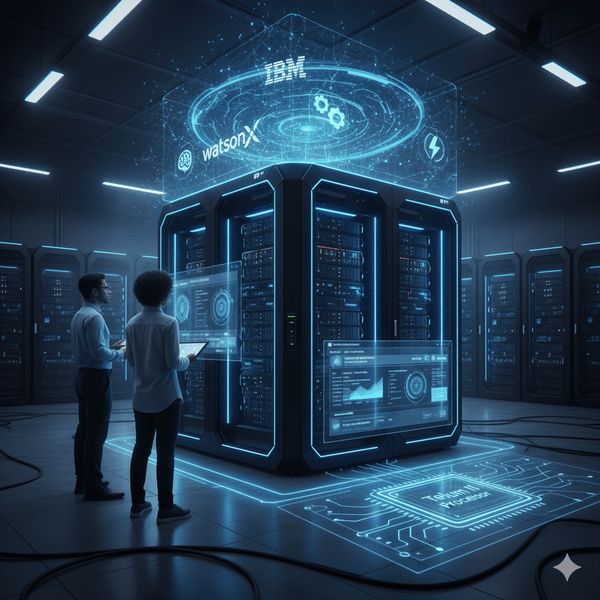

The AI Integration Angle (Generative AI for Legacy Systems)

But wait, there’s more. IBM’s latest hardware (z16/z17 with Telum II processor) has on-chip AI accelerators specifically designed for real-time inference. They’re not just running transactions—they’re running real-time fraud detection models on the data as it flows through, using AI and machine learning at the transaction level.

And then there’s watsonx Code Assistant for Z—a generative AI tool that addresses the skills gap directly:

- Explains what your 40-year-old COBOL code actually does (application modernization)

- Helps convert it to Java (selectively, not yeet-everything-and-pray)

- Generates documentation that was never written in the first place

- Accelerates application development by understanding legacy code patterns

This is the answer to “all our COBOL devs are retiring.” You don’t need to replace them—you augment the next generation with AI that understands legacy systems. It’s mainframe modernization powered by generative AI.

What This Means for the Mainframe Software Market

For IBM customers: You’re getting a mainframe that looks less like a mainframe every day. Single pane of glass management, cloud-native development, AI-powered operations, and true hybrid cloud integration. The skill gap is shrinking because your DevOps team can use tools they already know for infrastructure automation and application deployment.

For BMC customers: You’re getting the best DevOps tooling in the mainframe space. If your strategy is “we’re keeping our COBOL apps on z/OS but we need agile development and faster deployment cycles,” BMC has you covered. Topaz + AMI + Control-M is genuinely a modern development and operations pipeline that addresses workload automation and application lifecycle management across hybrid environments.

For Broadcom/Rocket customers: You’re getting… well-maintained legacy tools. Which you absolutely need. Because that mission-critical stuff has to keep running. But you’re not getting the future—you’re getting the present, maintained. Software consolidation and portfolio optimization are their game, and they play it well.

For the industry: The mainframe modernization services market is projected to grow from approximately $21.5 billion in 2024 to $76.16 billion by 2032, representing significant growth driven by digital transformation initiatives.

IBM is trying to make the mainframe relevant for the next 30 years by making it not feel like a mainframe. They’re betting on hybrid cloud integration, AI integration, and infrastructure as code.

BMC is betting that if you modernize the development experience with DevOps practices and automated operations, the platform stays relevant even if the underlying tech is ancient.

Broadcom and Rocket are betting that enterprises will pay top dollar for proven tools that keep the lights on during application modernization efforts, and they’re probably right.

The Hot Take

IBM is playing a different game than everyone else in the mainframe market. Broadcom and Rocket are fighting over who gets to be the maintenance provider for the next decade of legacy systems management. BMC is fighting to make mainframe development not suck and to solve the skills gap with modern tooling.

IBM is trying to make sure there is a mainframe market in 2050 by embedding it into the hybrid cloud fabric of enterprise IT.

The $40 billion question: Will enterprises actually adopt this hybrid cloud integration model, or will they keep running the mainframe in a corner with a “do not touch” sign?

Based on the AI integration capabilities, the substantial investment in hybrid cloud technologies, and the reality that digital transformation doesn’t mean abandoning infrastructure that works, the future points toward deeper integration rather than replacement.

The mainframe market isn’t dying. It’s transforming. And the winners will be whoever figures out how to bridge 60 years of proven infrastructure with cloud-native development, AI and machine learning, and modern DevOps practices.

The mainframe isn’t going anywhere. It’s just learning Kubernetes, running AI models, automating with Terraform, and pretending it’s been cloud-native all along.

What do you think? Is IBM’s hybrid cloud strategy the right move, or are they just burning cash trying to make COBOL cool? Is BMC’s DevOps approach more practical? Drop your takes below.